Sustainable Fintech: Making Money, Making Sense

Maria Azofra

Apr 8, 2022

Sustainable fintech, sometimes called green fintech or sustainable finance technology, is all about using innovation to make finance eco-friendly and socially responsible. It's a hot topic in a world increasingly concerned about the environment, and it's transforming how we handle money. In this quick read, we'll break down what sustainable fintech is, look at sectors that are already embracing it, and explore why it matters to you.

Sustainable Fintech in a Nutshell

At its core, sustainable fintech is the fusion of financial technology and eco-consciousness. It's like using the power of technology to make our financial systems kinder to the planet. With sustainable fintech, financial institutions, investors, and even everyday consumers can align their money moves with values like environmental preservation, social justice, and ethical business.

Who's on Board Already?

A bunch of sectors are jumping on the sustainable fintech bandwagon:

Banks and other payment services providers: Banks are going greener with mobile apps that encourage digital transactions, reducing paper waste and carbon emissions. They are also beginning to make investments in sustainable projects, given their potential for both economic and social impact.

Investors and Asset Managers: Thanks to sustainable fintech, you can now invest in products like green bonds and impact funds, which do good for the planet while also growing your wealth.

Insurances: Fintech is helping insurers understand climate risks better, leading to innovative products that protect against things like crop losses due to erratic weather.

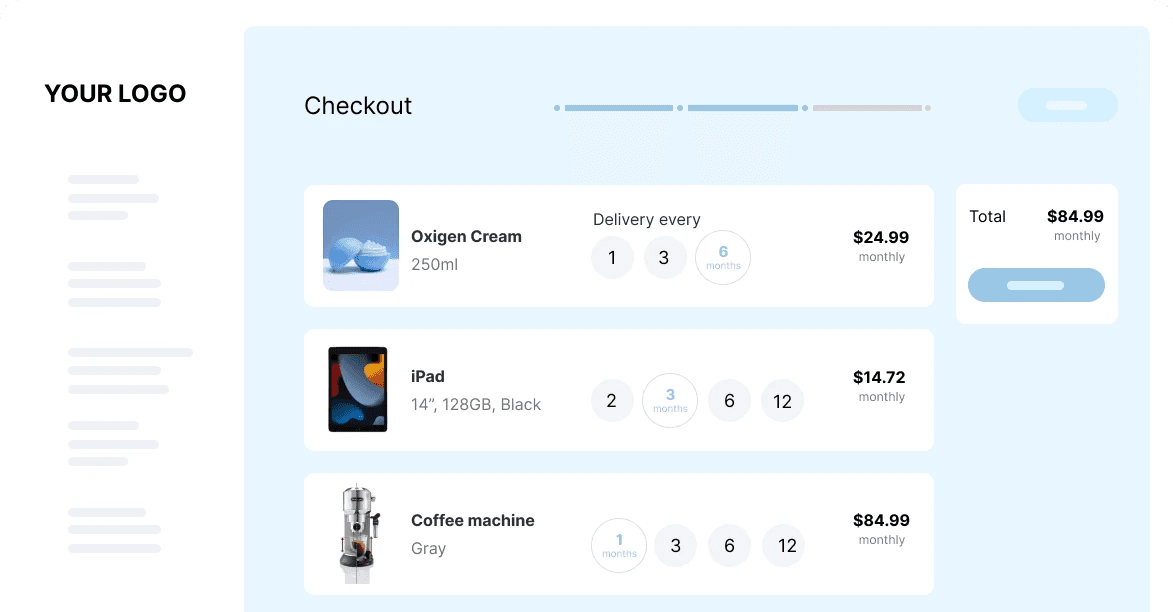

Retailers and manufacturers: More and more businesses are realizing the benefits of offering sustainable payment options to their customers, such as rent. This helps them meet their customers' demands, unlock new revenue streams and position their brand in a better way.

Why You Should Care

Sustainability isn't just a buzzword; it's a movement!

Around 73% of people worldwide say they'd change their habits to reduce their environmental impact, according to Nielsen.

In the US and the UK, 88% of consumers want companies to help them be more eco-friendly and ethical in their daily lives, says Sustainable Brands.

Over 70% of consumers in India and China are willing to pay extra for eco-friendly products, according to the IBM Institute for Business Value.

The sustainability market could hit $150 billion by 2023, per McKinsey. That's a lot of green (in every sense)!

In summary

Sustainable fintech is a win-win, making finance cleaner and more responsible. As the retail industry shifts towards sustainability, fintech is set to play a big role.

Platforms like Sharpei are leading the way, offering eco-conscious business solutions that also make financial sense. We have recently won two important awards in this regard:

Fintech Awards 2023 by Wealth & Finance International.

Most Sustainable FinTech 2023 by Finnovating.

Remember: It's not just about making money; it's about making sense! 💚💚💚

Related posts

Ready To Join The Circular Movement?

United for a smarter shopping experience and a better planet