What is Auto Pay? Simplify Your Bill Payments Today

Patricia Bernal

May 6, 2025

The Auto Pay Revolution: How It's Changing Finance

What is auto pay? It's the automatic payment of recurring bills from your bank account or credit card. This eliminates manually writing checks or initiating online payments each month. Auto pay has become a convenient cornerstone of modern personal finance. Many use it for recurring expenses like utilities, rent, and loan payments, ensuring on-time payments without the hassle. But auto pay's influence extends beyond individual consumers.

The Rise of Auto Pay and the Subscription Economy

The growth of the subscription economy has significantly fueled auto pay’s rise. Consider how many services you subscribe to – from streaming platforms and software to meal kits. Auto pay seamlessly charges customers on a recurring basis, powering these businesses. This convenience has made subscription models incredibly popular, transforming how we consume everything. Learn more about this model: How to master the e-commerce subscription model. This interconnectedness has significantly changed financial management.

The Growing Prevalence of Auto Pay

Auto pay usage is remarkably common. As of October 2023, over 75% of consumers used auto pay for at least one bill, especially for services like streaming. This reflects a growing preference for digital and automated payment systems. These systems offer convenience and efficient management of recurring expenses by electronically executing payment instructions at scheduled intervals. This reduces missed payments and penalties. Explore more detailed statistics: here. However, this convenience has potential downsides.

Balancing Convenience and Control

While auto pay offers convenience, maintaining account oversight is crucial. Automatic deductions can lead to overdraft fees if you aren't diligently monitoring your balance. The "set it and forget it" nature can also obscure spending habits, potentially leading to budget overruns.

Actively managing your auto pay settings and regularly reviewing bank statements are vital for financial health. Balancing convenience and control is key to maximizing auto pay’s benefits while minimizing potential risks.

Auto Pay Pros and Cons: Beyond the Obvious Benefits

Auto pay, the automatic payment of recurring bills, offers significant convenience. But is automatic bill payment always the best choice? Understanding the advantages and disadvantages of auto pay is crucial for making sound financial decisions. This means looking past the immediate benefits to truly grasp its impact on your finances.

The Upsides of Automating Your Payments

Auto pay offers compelling advantages. First, it virtually eliminates late payment fees. Consistent, on-time payments also positively impact your credit score. This is particularly helpful for building or maintaining good credit.

Auto pay also simplifies financial management. It frees up time and mental energy by automating routine tasks.

The Potential Pitfalls of Auto Pay

However, auto pay has its drawbacks. A major concern is the risk of overdraft fees. If you aren't diligently monitoring your account balance and a payment exceeds available funds, you'll incur these charges.

Another issue is the potential for budget blindness. Automated payments can disconnect you from your spending habits. This can make it harder to track expenses and stick to a budget, potentially leading to overspending.

To illustrate the key differences and similarities between the benefits and drawbacks of using automated payment systems, let's look at a comparison table.

Auto Pay Pros and Cons Comparison: This table provides a clear side-by-side comparison of the benefits and potential drawbacks of using automated payment systems for bills and subscriptions.

Benefits of Auto Pay | Potential Drawbacks of Auto Pay |

|---|---|

Avoids late payment fees | Risk of overdraft charges |

Improves credit score | Potential for budget blindness |

Simplifies financial management | Requires consistent account monitoring |

Saves time and reduces mental clutter | Difficulty adjusting to changing bills |

Ensures consistent and timely payments | Less control over individual payments |

As we can see from the table, while auto pay offers considerable benefits like avoiding late fees and simplifying financial management, it also requires careful account monitoring to avoid potential overdrafts and maintain budget awareness.

Weighing the Pros and Cons

The ideal approach depends on individual financial habits. If you tend to forget due dates or struggle with consistent bill payments, auto pay could be beneficial.

However, if you are a meticulous budgeter who prefers close control over every transaction, manual payments might be a better fit. Combining auto pay with diligent account monitoring and budgeting tools can be an effective strategy for those who value both convenience and control. Consider using tools like YNAB (You Need A Budget) or Mint to maintain better control of your finances.

Setting Up Auto Pay: A Practical Walkthrough

Automating your bill payments can significantly simplify your financial life. This walkthrough offers practical steps for setting up auto pay, explaining the different methods available and highlighting best practices for a secure and efficient experience. Understanding the nuances of various auto pay systems helps you make informed decisions about managing your finances.

Choosing the Right Auto Pay Method

There are two main ways to set up auto pay: bank-initiated payments and biller-direct payments.

Bank-initiated payments are scheduled through your online banking platform. You authorize your bank to send payments to designated billers at specified intervals. This gives you a centralized location to manage your outgoing payments.

Biller-direct payments, on the other hand, are set up through the biller's website or customer portal. You provide your bank account or credit card information, authorizing the biller to withdraw payments directly.

Choosing the best method depends on your individual needs and the biller's capabilities.

Bank-Initiated Payments: These offer centralized control over all your bills within your banking platform. You can see all your scheduled payments in one place.

Biller-Direct Payments: These may provide specific payment options or discounts not available through bank payments. Some billers may offer incentives for using their direct payment system.

Carefully consider which approach offers the most convenience and control for your specific bills. This will ensure a smooth and efficient auto pay experience.

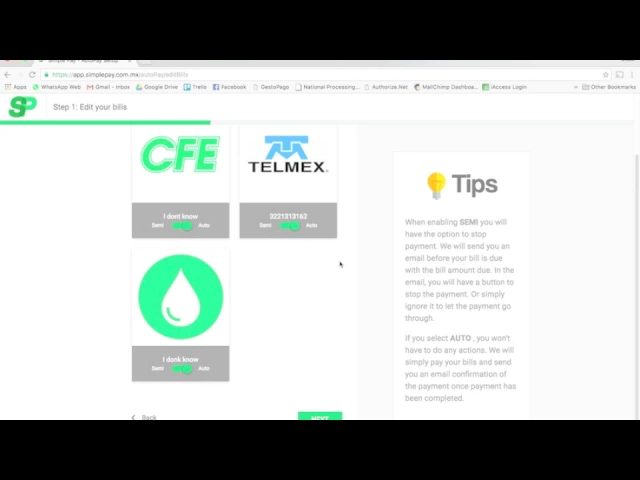

Setting Up Auto Pay: A Step-by-Step Guide

Whether you opt for bank-initiated or biller-direct payments, the setup process is usually straightforward. Here’s a general overview:

Gather Your Information: Collect your account numbers, billing addresses, and login credentials for both your bank and the billers you wish to automate. Having everything readily available will streamline the process.

Access the Appropriate Platform: Log into your online banking portal for bank-initiated payments, or the biller’s website for biller-direct payments.

Locate the Auto Pay Section: Find the "Bill Pay" or "Auto Pay" feature within the platform. The location may vary depending on the specific website.

Enter Biller Information: Input the requested details about the biller, including the account number and billing address. Double-check this information to ensure accuracy.

Set Payment Amount and Schedule: Specify whether you want to pay the full balance or a fixed amount, and choose the payment frequency (e.g., monthly, bi-weekly).

Confirm and Review: Carefully double-check all information before confirming. It’s wise to set up email or text notifications to stay informed about upcoming payments.

Tips for Managing Auto Pay Effectively

Setting up auto pay is the first step. Actively managing your automated payments is crucial for avoiding potential issues.

Regular Account Monitoring: Regularly review your bank statements to ensure payments are processing correctly and that your account has sufficient funds to cover them. This helps avoid overdraft fees.

Payment Calendar: Maintain a calendar of upcoming auto payments. This provides a clear overview and helps prevent overdrafts and unexpected withdrawals.

Notification Management: Customize your notification settings to receive timely alerts without overwhelming your inbox. This balance allows for peace of mind while staying informed.

By following these best practices, you can enjoy the convenience of auto pay while maintaining complete control over your finances.

Who Really Uses Auto Pay? Surprising Patterns Revealed

While auto pay is growing in popularity, adoption isn't universal. Different demographic groups and industries show unique trends in how they use automated payments. This raises an important question: who is actually using auto pay, and what motivates them? Exploring these trends reveals interesting insights into financial behaviors and technology adoption. The data chart above illustrates auto pay usage across various income levels. As you can see, there's a clear correlation between income and auto pay adoption.

Income and Age Play a Significant Role

Demographically, auto pay use varies across income levels and age groups. High earners (those making over $100,000 annually) are more likely to use auto pay. As of January 2025, approximately 48.2% of this group uses auto pay.

This percentage decreases to 42.2% for those earning between $50,000 and $100,000. For those earning less than $50,000, usage drops further to 31%.

Generational differences are also evident. Baby Boomers lead in auto pay usage at 43%. Generation Z trails behind at 34.6%. These differences underscore how financial habits and comfort with technology influence auto pay usage. More detailed information can be found at Auto Pay Adoption Trends. This data confirms that while auto pay is common, socioeconomic and generational factors still impact its adoption.

Visualizing Auto Pay Adoption

To better understand the relationship between income and auto pay usage, the following table provides a detailed breakdown:

Auto Pay Adoption by Demographic Groups This table presents statistics on auto pay usage across different income levels, age groups, and technological proficiency levels based on current market research.

Demographic Group | Auto Pay Adoption Rate | Primary Bill Types |

|---|---|---|

< $50,000 Annual Income | 31% | Utilities, Rent |

$50,000 - $100,000 Annual Income | 42.2% | Utilities, Rent, Subscriptions |

> $100,000 Annual Income | 48.2% | Utilities, Rent, Subscriptions, Credit Cards |

Baby Boomers | 43% | Utilities, Rent, Credit Cards |

Generation Z | 34.6% | Subscriptions, Phone Bills |

Key insights from this table include the positive correlation between income and auto pay adoption, as well as the variation in bill types paid automatically across different demographic groups.

Industry Adoption and Resistance

Auto pay adoption also fluctuates across industries. Sectors like utilities, subscription services, and telecommunications, which often use recurring billing models, have embraced auto pay. It streamlines payment processing and cuts administrative costs.

This efficiency is vital for their operations. However, some industries remain hesitant about auto pay. This could be due to security concerns, data privacy issues, or the need for more flexible payment options. Recognizing these industry-specific nuances is important for businesses looking to implement or enhance their auto pay systems.

Beyond Personal Finance: Auto Pay in Global Business

Auto pay is transforming how businesses operate internationally, moving beyond personal banking and into the complexities of global commerce. This shift from manual transactions to automated payments signifies a major change in financial operations. For businesses, auto pay offers solutions for vendor management, cash flow optimization, and reduced administrative work. Let's explore how companies are leveraging these systems for a competitive edge.

Streamlining B2B Transactions

Automated payment systems are vital for business-to-business (B2B) transactions. They simplify recurring payments like subscriptions, contracts, and inventory orders. This reduces manual processing, allowing businesses to concentrate on strategic goals. Global growth in automated payment systems is fueled by advancements in digital payment technologies.

Stripe reported an 11% increase in global payments revenue in 2022, exceeding $2.2 trillion. This growth is largely attributed to the rise of automated and digital payment solutions. In B2B, auto pay is particularly useful for managing recurring transactions like:

Financial contracts

Subscription services

Inventory replenishment

These systems let customers authorize vendors to automatically debit agreed-upon amounts, improving cash flow predictability and reducing administrative burdens. Integrating these automated systems has streamlined financial operations across industries, contributing to a more efficient and reliable global financial system. For more detailed information, explore Automated Payment Systems Explained. This growth highlights the significant influence of auto pay in global business.

Navigating International Payment Infrastructures

Implementing auto pay internationally presents distinct challenges. Payment infrastructures vary significantly across countries due to differences in technology, regulations, and cultural views on financial automation. Businesses operating internationally must carefully plan and adapt.

Some regions prefer mobile payments, while others rely on traditional banking. Adapting to these local preferences is crucial for successful global auto pay implementation.

Gaining a Competitive Advantage

Businesses adopting sophisticated auto pay systems gain significant competitive advantages. Automating invoice processing and payments drastically reduces administrative costs. This frees up resources for other strategic initiatives.

Predictable cash flow through automated payments enables better financial forecasting and investment planning. Auto pay also strengthens vendor relationships by ensuring timely and accurate payments, building trust and reliability. This increased efficiency and reliability positions businesses for greater success in the global market.

The Future of Auto Pay in Business

The application of auto pay in business is constantly evolving. As technology progresses, we can anticipate more integrated and intelligent payment solutions. These advancements will further empower businesses to optimize financial operations and enhance their competitive standing in a dynamic global market.

Protecting Your Money: Auto Pay Security Essentials

Auto pay offers undeniable convenience, but security is a valid concern with automated transactions. Understanding how these systems protect your money is essential for peace of mind. This section explores the security measures safeguarding your finances when using auto pay and practical steps you can take to enhance your security.

How Financial Institutions Protect Your Money

Financial institutions employ robust security measures. Encryption is fundamental, converting your data into an unreadable format during transmission and protecting it from unauthorized access. Many institutions also use multi-factor authentication, requiring several verification steps for account access, adding extra security beyond usernames and passwords.

Furthermore, fraud detection algorithms are commonly employed. These systems monitor transaction patterns, flagging suspicious activity for review and proactively preventing unauthorized transactions.

Practical Strategies For Enhanced Security

You can take steps to enhance your security beyond the built-in safeguards. Regularly monitoring your account activity is crucial for quickly identifying unauthorized transactions. Setting up transaction alerts provides real-time notifications of payments, making it easier to spot anything unusual. You might be interested in: How to master the benefits of lease-to-own options.

Be wary of phishing scams that try to trick you into revealing sensitive information. Never click on suspicious links or provide personal information in unsolicited emails or texts. If something seems off, contact your financial institution directly.

Staying Informed and Responding to Threats

Stay informed about potential threats by reviewing your financial institution's security updates and recommendations. Understanding the latest security best practices is crucial for protection. If you suspect unauthorized activity, immediately contact your financial institution to report the incident and secure your account.

Having a plan for security breaches can mitigate financial impact. This includes knowing how to freeze your accounts, change passwords, and dispute unauthorized transactions.

Balancing Convenience With Vigilance

Auto pay offers significant convenience, but vigilance is essential. By understanding the security features and implementing practical safety measures, you can confidently use auto pay while minimizing risks and enjoy the ease of automated payments while staying financially secure.

Mastering Auto Pay: Smart Management Techniques

Auto pay offers incredible convenience, but without proper management, it can lead to financial frustration. This section provides practical techniques to take your auto pay experience from potentially chaotic to perfectly controlled. These strategies, drawn from financial experts, will empower you to enjoy the ease of auto pay while maintaining complete control over your finances.

Building a Comprehensive Payment Calendar

One of the most effective ways to manage auto pay is by creating a payment calendar. This calendar should include all your automated payments, noting the due date, amount, and the account from which the payment is debited. This visual overview clearly shows your upcoming financial commitments. This helps you avoid unexpected withdrawals and maintain a healthy account balance. For example, if your mortgage, car payment, and streaming services are all due the same week, you can ensure you have sufficient funds.

The Strategic Advantage of a Dedicated Auto Pay Account

Consider setting up a dedicated checking account specifically for auto pay transactions. This separates your automated payments from your daily spending. It gives you a clearer picture of your regular expenses. This separation also simplifies budgeting and reduces the risk of overdraft fees. You can allocate a set amount to this account monthly, confident that your automated bills are covered without affecting your everyday spending.

Effective Alert Systems: Stay Informed, Not Overwhelmed

Most banks and billers offer payment notifications through email or text. These alerts remind you of upcoming payments and confirm successful transactions. However, too many notifications can become overwhelming. Customize your alert settings to receive only essential notifications, such as payment confirmations and alerts for failed transactions. This keeps you informed without unnecessary clutter. Setting up low-balance alerts for your dedicated auto pay account provides extra overdraft protection.

Handling Variable-Amount Bills

Managing bills with fluctuating amounts, like utilities, can be tricky with auto pay. One approach is to set a slightly higher payment than your average bill. This creates a cushion for occasional increases. Remember to review your account regularly to avoid accumulating excessive credit. Alternatively, some billers allow you to set a maximum auto pay limit, preventing unexpectedly large withdrawals.

Managing Auto Pay While Traveling

Extended travel can complicate auto pay. If you’re traveling internationally, inform your bank and credit card companies to prevent potential transaction blocks due to unusual activity. For variable bills, consider temporarily switching to manual payments or adjusting your auto pay limits during your trip to account for spending changes. Learn more in our article about subscription-based e-commerce.

Adjusting Auto Pay During Financial Hardship

During financial difficulties, communicate with your billers. Many offer hardship programs that can temporarily adjust payment amounts or due dates. Don't hesitate to explain your situation and explore the options available. This proactive communication can prevent late payments and protect your credit score. You might be able to lower your auto pay amounts or temporarily suspend automatic payments while you address your financial challenges.

Sharpei offers innovative payment solutions for businesses looking to provide flexible options at checkout. Learn more about how Sharpei can enhance your business at https://www.gosharpei.com.

Related posts

Ready To Join The Circular Movement?

United for a smarter shopping experience and a better planet