Loan Automation Processing System: How Automation Streamlines Lending from Application to Repayment

Sofia Rangoni

Dec 3, 2025

Understanding Loan Automation Processing Systems

How Loan Automation Differs from Manual Processes

Traditional loan processing is often a marathon of paper forms, phone calls, and back-and-forth emails. Each step, from gathering documents to verifying information, relies on human input, which creates bottlenecks and raises the risk of mistakes. Loan automation processing systems replace these outdated routines with a digital workflow. Instead of shuffling paperwork, the system collects, verifies, and routes information instantly, shrinking approval times from days to minutes while minimizing human error.

Key Elements and Workflow Overview

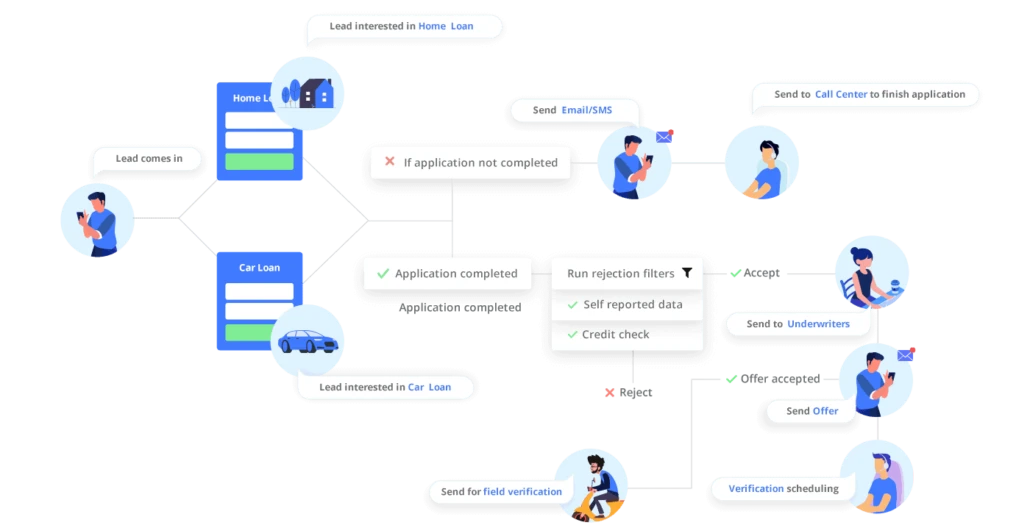

A loan automation processing system unifies disparate steps into a seamless pipeline. The process typically begins with capturing the application digitally, automatically pulling data from various sources to minimize manual entry. Next, the system verifies identification, reviews documentation, and runs credit checks simultaneously, with results analyzed in real-time. Decision engines weigh this information based on lender-defined criteria before generating a clear approval or decline, all without a paper trail.

Finally, automated monitoring oversees ongoing loan servicing, tracking repayments, and flagging issues for human intervention only when necessary. Each component communicates with the next, eliminating the silos that traditionally slow lending to a crawl.

With the core of automation in focus, it’s time to look closer at the building blocks that deliver true efficiency and accuracy across the entire loan lifecycle.

Core Features of a Loan Automation Processing System

Automated Application Intake

No more endless data entry or manual sorting of forms. Automated intake instantly captures, validates, and organizes applicant information from digital channels, reducing the risk of missing paperwork and significantly reducing processing time.

Digital Document Collection and Verification

Banks and lenders can request, receive, and verify documents such as pay stubs, tax returns, and IDs without the need for paper shuffling. Automation checks file completeness, flags anomalies, and validates authenticity, so nothing falls through the cracks.

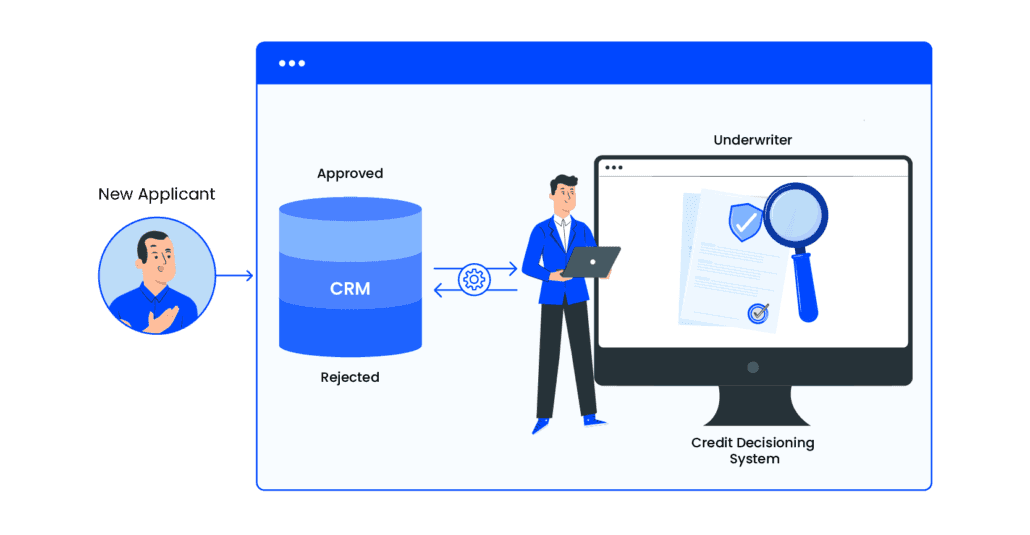

AI-driven Credit Assessment and Underwriting

Algorithms analyze credit scores, transaction histories, and alternative data in seconds. This approach reveals details that manual reviews might miss, enabling data-backed risk decisions without bias or delay.

Decisioning Engines and Real-Time Approvals

Automated engines apply lending policies and regulatory criteria to applicant data, producing near-instant approval decisions. This rapid feedback loop means qualified borrowers know where they stand immediately.

Seamless Integration with Other Financial Tools

The system integrates with core banking, CRM, and payment gateways to automatically push and pull data. This eliminates copy-paste errors and ensures every department always works with the most up-to-date information.

Automated Loan Servicing and Repayment Management

Once the loan originates, automated servicing manages billing schedules, payment reminders, collections, and delinquency tracking. Borrowers enjoy clear notifications, and lenders avoid costly manual interventions.

Understanding these essential features sets the stage for appreciating the specific advantages automation brings to lenders and borrowers alike, from speed and accuracy to improved transparency throughout the lending lifecycle.

Benefits for Lenders and Borrowers

Accelerated Processing and Reduced Turnaround Times

Manual loan processing can leave applicants waiting days or even weeks for answers. With automation, decisions and verifications happen in minutes. Lenders can handle more applications without extra staff, while borrowers receive rapid updates and approvals. Speed drives satisfaction for everyone involved.

Cost Savings and Improved Accuracy

Automation slashes the resources needed for data entry, file management, and repetitive follow-ups. By eliminating manual touchpoints, banks and credit unions can allocate budget elsewhere, all while avoiding costly mistakes. Precisely programmed workflows keep calculations and document checks on track, thereby reducing the risk of expensive human errors.

Fewer Errors and Stronger Compliance

Every click and keystroke in traditional lending presents a new opportunity for mistakes. Loan automation systems enforce consistent checks, flagging incomplete forms, spotting discrepancies, and auto-generating compliance reports. This keeps lenders ahead of regulatory requirements and spares borrowers from frustrating back-and-forth.

Enhanced Borrower Experience

Automated systems allow applicants to upload documents, track progress, and communicate securely from any device. Status updates arrive quickly, questions are answered promptly, and borrowers can move forward faster. For those seeking clarity and convenience, automation turns the lending journey from a chore into a breeze.

Yet, as the industry harnesses automation’s speed and efficiency, new challenges emerge, especially around data security, system integration, and maintaining a human touch when it counts.

Up next, we’ll explore hurdles that lenders face in implementing automation and how they can tackle these issues head-on.

Common Challenges and How to Overcome Them

Data Security and Compliance Concerns

Digitizing the lending process means handling sensitive personal and financial data. Loan automation systems must guard against breaches and meet demanding regulatory standards like GDPR or GLBA. Encryption of data at rest and in transit, advanced multi-factor authentication, and regular third-party security audits can go a long way in keeping data safe. Automated audit logs make compliance tracking easier, but teams still need to stay updated on changing regulations and update systems promptly.

Integration with Legacy Banking Systems

Many banks and lenders rely on legacy software built years ago, making integration with modern automation tools a headache. Bridging the gap often requires custom APIs or middleware to translate data formats and enable real-time communication. Collaboration between IT, vendors, and business teams is crucial. Starting with non-critical processes for pilot testing before full-scale integration lowers risk and uncovers hidden snags early.

Balancing Automation with Human Oversight

While automation streamlines repetitive tasks, not every scenario lends itself to a one-size-fits-all algorithm. Complex cases, thin credit files, or flagged applications often need human judgment. The solution isn’t to cut people out of the loop but to build clear escalation paths within workflows. Combining automated decisioning with skilled loan officers ensures that exceptional cases get the careful review they deserve.

With the right strategies in place, these challenges become stepping stones instead of roadblocks. As the landscape evolves, let’s look ahead to some of the most transformative developments shaping the future of loan processing.

Emerging Trends in Loan Automation

AI and Machine Learning for Smarter Decisioning

Underwriting is shedding its traditional, rigid rulebooks. Today, predictive models, trained on vast amounts of historical data, flag risk patterns that human analysts might miss. Lenders now blend income histories, employment shifts, and spending habits to paint a clearer financial portrait. AI systems spot inconsistencies in applications, flag likely fraud attempts in seconds, and even adjust approvals based on changes in economic outlook. This shift means fewer loan defaults and faster, more confident decision-making for all parties.

Personalised Lending Journeys

Automation isn’t just about speed; it’s about relevance. Modern systems use behavioural analytics and real-time insights to customize everything from product suggestions to repayment reminders. Borrowers might see loan offers matched to upcoming life events or be nudged towards payment plans they’re statistically most likely to manage.

The result? Less one-size-fits-all frustration, more loyal customers, and reduced delinquency rates.

No-Code Automation Tools for Banks

Building lending workflows once took months of IT development. No-code platforms are changing the equation, letting banks and credit unions build, tweak, and launch automated lending processes using visual interfaces. This approach empowers business teams to respond to regulatory updates or customer feedback quickly, without the endless queue of dev requests. It democratizes innovation and shrinks time-to-market for new lending services.

As these trends continue to reshape lending, understanding how to navigate the new landscape will be crucial for anyone evaluating next steps. The following guide will help you pinpoint what truly sets a modern loan automation solution apart.

How to Choose the Right Loan Automation Processing System

Picking a loan automation processing system is more than comparing checklists: it's about finding the right fit for your institution's workflows, customers, and growth ambitions. With so many vendors and shiny features, it pays to dig deeper and ask the right questions, think about integration, and plan for the future.

Key Questions to Ask Solution Providers

Start every evaluation with clear questions. What specific lending products does the system support consumers, small businesses, or both? Does the solution offer end-to-end automation, from application to repayment, or just pieces of the process? Can you customize workflows without hiring developers?

Clarify how data security is handled and verify compliance with regulatory certifications. Ask about the update schedule: how often does the platform evolve to keep pace with changing banking regulations or technology standards?

Essential Integrations to Look For

No system works in a vacuum. Check that the platform can connect seamlessly with your existing core banking software, underwriting tools, credit bureaus, and customer communication channels. Look for pre-built integration options or robust APIs that don't require excessive custom development. If you rely on e-signatures, digital KYC, or payment gateways, confirm they’re supported. The smoother the handoff between systems, the less manual intervention and friction for both your team and your borrowers.

Evaluating Scalability and Future-Readiness

Today’s needs are only half the story; consider growth and changing markets. Will the system keep up as you scale loan volumes or branch into new lending products? Ask if there's a transparent plan for cloud expansion or handling higher data loads. Find out how the vendor manages updates and support as regulations shift. Bonus points if the platform supports adding new automation features, AI enhancements, or analytics modules down the line, so you aren’t boxed in down the road.

Once you’ve identified your must-haves and mapped your priorities, real-world success stories can offer a reality check for leaping automated lending. Next, let’s look at how lenders in the field are putting these systems to work to drive measurable improvements and outcomes.

Real-World Examples: Automation Impacting Lending Success

Case Study: Boosting Approval Rates with Automation

A mid-sized credit union in the Midwest struggled with slow loan approvals, often taking several days to finalize decisions. By adopting a loan automation processing system equipped with AI-driven credit analysis and real-time data verification, they reduced approval times to under two hours. The automation platform flagged inconsistencies instantly and verified borrower information directly with third-party data providers. As a result, loan officers spent less time on manual checks and more time handling complex cases, while the institution’s approval rate increased by 22% thanks to faster, more accurate assessments.

Case Study: Reducing Processing Costs through Integration

A regional mortgage lender faced mounting operational costs, with separate teams handling intake, underwriting, and servicing across different legacy systems. They unified these steps with an automated processing platform that connected digital applications, document verification, underwriting, and repayment management. This integration eliminated redundant data entry and enabled automated cross-checks at every stage, reducing processing costs by 30% in the first year. Employees shifted from repetitive data tasks to roles focused on borrower support, and error rates fell sharply.

These real-world successes highlight the transformative power of loan automation. But what does it take to begin implementing these solutions in your own organization? The next steps lay out a pathway for turning automation from a concept into everyday practice.

Getting Started with Loan Automation Processing

Steps for Smooth Implementation

Diving into loan automation doesn't require overhauling your entire system overnight. Start with a clear map of your current lending workflow. Identify steps that regularly slow things down: maybe a backlog in application intake, or approval delays because of manual document checks. These spots are prime for automation.

Next, gather insights from team members who interact with the process daily. Their feedback highlights pain points and reveals which tasks are ready to be handled by smart systems. Involving your front-line staff not only uncovers real issues but also helps with adoption later.

Select an automation platform that fits your institution’s needs and can connect with your existing tools. Strong integration means less friction, and data can flow without constant IT intervention. Run pilot programs on narrowly-defined processes first, like onboarding new applicants or preliminary risk assessment. These focused efforts allow you to spot glitches and adapt quickly, before rolling out automation more broadly.

Continuous Monitoring and Improvement

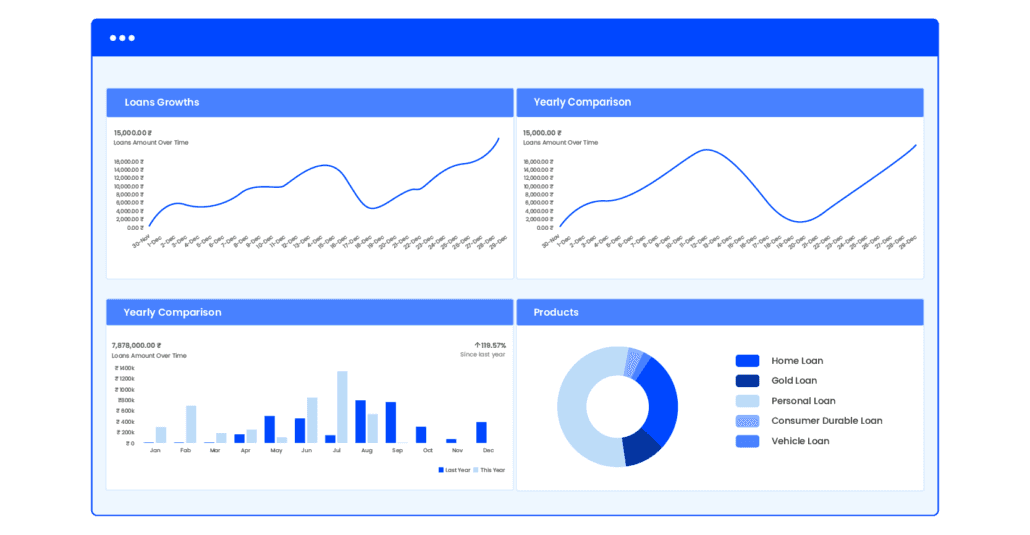

Launch is just the beginning. Monitor performance using clear benchmarks: time-to-decision, approval rates, error counts, and customer satisfaction metrics. Use dashboards or reports generated by your automation software to keep track of those metrics.

Regular check-ins with staff and borrowers can reveal unexpected issues or opportunities for improvement. A/B testing new automation tweaks often leads to faster and more accurate workflows. The goal isn’t to “set and forget”, it’s to continuously tune your lending process, adapting to regulatory updates, customer feedback, and advances in technology.

With a solid plan and commitment to ongoing refinement, any lender can transition from manual processes to an adaptive, automated lending environment.

Related posts

Ready To Join The Circular Movement?

United for a smarter shopping experience and a better planet