Launching Sharpei AI, Our AI Workforce for Equipment Finance

Julian Azofra

Dec 22, 2025

I have always worked in the equipment leasing and financing industry.

First, I built my own electronics leasing company, and understood all the pains Merchants had to go through if they wanted to offer leasing options to customers.

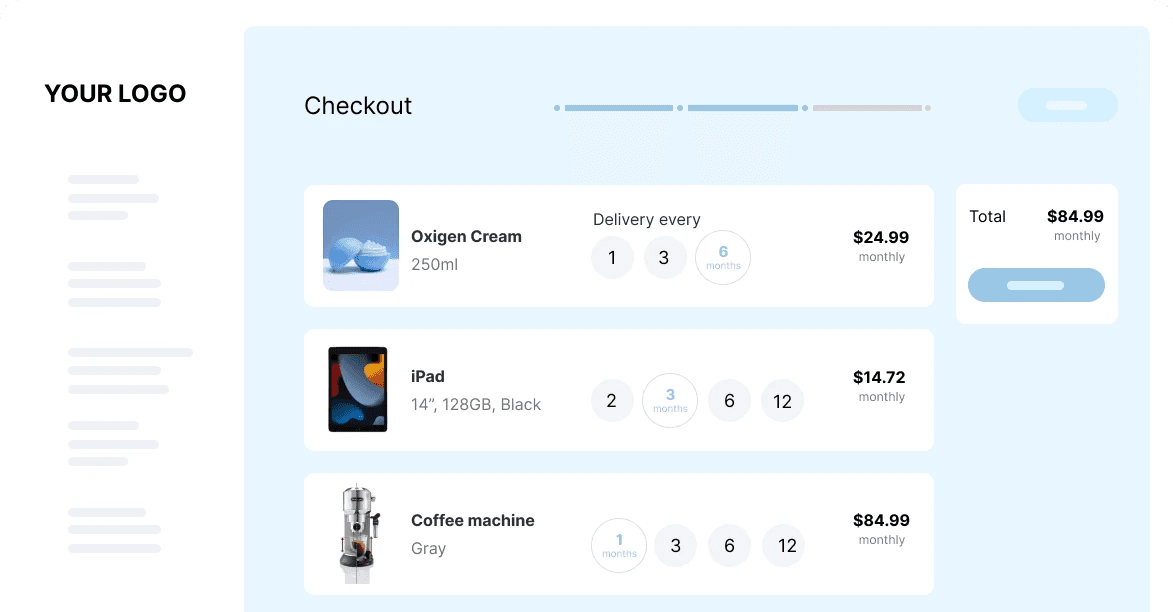

Then, we solved all those problems for them, automatising customer applications at the Merchant level, with partners like LG and Mercedes Ebikes.

On the surface, it looked modern: slick checkout, equipment leasing embedded as a payment option, approvals handled in the background.

But behind every clean “Lease it now” button, there was always the same picture:

Reps copying data from emails into a LOS

Ops chasing customers and vendors for missing documents

Underwriters opening yet another PDF to find the one line they actually need

The front end looked like 2025.

The back office still felt like the 1990s.

That’s the gap Sharpei AI is built to close.

A day in the life of an EF team

If you run an equipment finance team, this will sound familiar.

It starts with a few channels:

Vendors emailing “Can you quote this customer?”

Direct applications from the website

Brokers sending PDFs, bank statements, tax returns

Every day, originations and sales spend hours on:

Asking for “one more document”

Clarifying basic information (“is this a newco?”, “any guarantors?”)

Copy-pasting data from PDFs and emails into your LOS or CRM

Chasing internal approvals and re-pushing updates into systems

By the time a clean file exists, several people have touched it, nobody remembers the latest version, and the underwriter is already behind on their queue.

That’s not a one-off, that’s the default workflow in most equipment finance operations.

The problem, put in numbers

When we started mapping this with equipment finance companies and bank EF teams, the pattern was painfully consistent:

Around 60–70% of the time in originations is spent on manual tasks: data entry, document chase, status updates.

Standard deals often take 3–10 days to move from first contact to decision.

A large percentage of applications arrive NIGO (Not In Good Order).

Good customers quietly drop off or go to faster competitors because the process is slow and opaque.

This isn’t just an annoyance. It hits:

Conversion: abandoned deals and frustrated vendors.

Capacity: reps and underwriters capped by manual work, not by demand.

Cost: high operational overhead to move each deal from A to Z.

That’s the core problem we wanted to tackle with AI for equipment finance, not with another form or another portal.

Why existing tools haven't fixed it

To be fair, the industry has not been sitting still.

LOS and portals gave structure and better data storage.

RPA and workflow tools automated some repetitive steps.

Custom spreadsheets and internal tools filled gaps for specific teams.

But they all share one limitation: they don’t live where the actual mess happens.

A LOS is great once the data is clean and complete. It doesn’t solve the last mile of data collection and document hunting.

Portals look nice, but customers and vendors still fall back to email when they’re confused.

RPA and workflows break whenever formats, templates or processes change, and they don’t understand context the way a human would.

The result is familiar: you have more systems, more logins, and still the same email and spreadsheet chaos on top.

We didn’t want to build another system.

We wanted to build an AI Workforce that sits on top of everything you already use and simply does the grunt work.

What we mean by “AI Workforce”

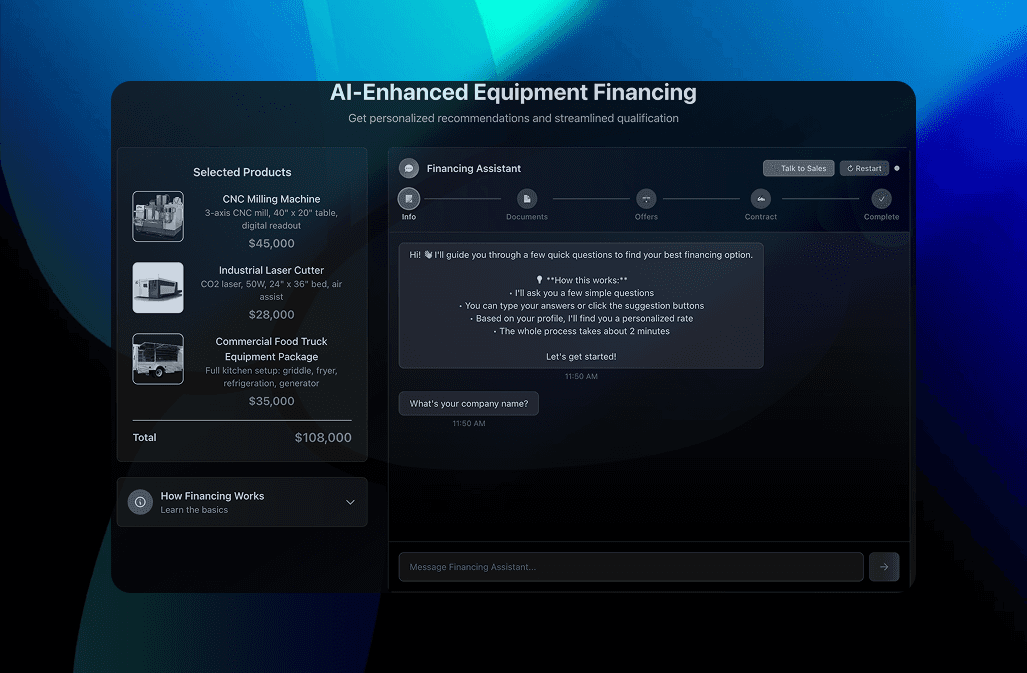

When we say “AI workforce for equipment finance”, we mean a set of AI agents that behave like digital team members. They handle conversations, data collection and updates across channels and systems, so your humans can focus on credit decisions, relationships and exceptions.

In Sharpei AI today, this shows up as two core agents. But I have to reveal we are already working on +20 different use cases through all the financing and leasing lifecycle. From applications, to upgrades, renewals and asset reselling at the end of the leasing term:

Intake Agent

Talks to customers and vendor reps (chat, forms, email)

Guides them through the application process

Collects and validates all required data and documents

Makes sure submissions are complete, not NIGO, before they hit the queue

Ops Assistant

Reads emails and documents (PDFs, bank statements, tax returns, invoices)

Extracts and structures the relevant data

Updates your LOS and CRM

Prepares a clean, summarised file for underwriters

Helps your team make better-informed decisions.

Humans still own the credit policy.

Humans still sign off on approvals.

Sharpei AI doesn’t replace underwriters or sales; it replaces the busywork around them.

That’s the difference between generic “AI for leasing operations” and an AI agent for equipment finance that is actually useful on Monday morning.

Concrete workflows: Before vs After

Let’s make it real with a common workflow.

Workflow for Vendor Finance Intake

Before

A vendor sends a customer to your finance program. The real flow looks like:

Vendor sends an email: “Can you quote this customer?”

Your team replies with a form or PDF

Customer partially fills it out, forgets to attach a few documents

Your rep chases missing info, one email at a time

Someone retypes everything into the LOS, uploads documents, and flags missing items

By the time an underwriter sees the file, three people have touched it, and the vendor is asking for updates.

After, with Sharpei AI

Vendor shares a simple link or embed to your Intake Agent

The Intake Agent walks the customer (or vendor rep) through the process:

asks context-aware questions

explains what each document is and why it’s needed

validates that files are legible and complete

Once done, the Ops Assistant:

Reads the submission

Structures the data and sends it into your LOS or CRM

Tags any exceptions or red flags

The underwriter opens a single, clean view: all data in the right fields, documents correctly labelled, basic checks already done.

Early results and what we’ve learned so far

We’re still early, but some patterns are already clear from pilot projects:

Teams report significant reductions in manual touches per deal in originations, up to 70%.

Standard decisions move from days to hours or minutes when the Intake Agent handles data and doc collection up front.

Reps and underwriters say they finally spend more time on “real deals” and less time on admin

One originations lead put it simply:

“Before Sharpei AI, my inbox was my job. Now I actually spend my day on deals.”

Are we done? No. But we’ve seen enough to be confident that AI originations automation is no longer a wild idea. It’s an operational advantage.

What comes next: EF in 3–5 years with AI

We believe that in 3–5 years:

Every serious equipment finance platform will have an AI agent for equipment finance sitting between customers, vendors and internal systems.

Manual data entry will be the exception, not the rule.

New programs will launch faster because you won’t need to staff up a small army each time.

The best EF teams will differentiate on speed, clarity and experience, not just on rate.

Our goal with Sharpei AI is simple:

Automate leasing workflows end-to-end where it’s safe and high impact.

keep humans where judgment and relationships matter.

Allow EF teams to grow volume without growing headcount at the same rate.

To get there, we don’t just need customers. We need design partners.

A call for design partners

If you:

Run originations, sales or operations in an equipment finance company or a bank EF unit.

Feel your team is buried in email and manual work.

Want to test AI for leasing operations without ripping out your LOS.

We’d love to talk.

We’re opening a small group of design partners who will:

Co-design workflows with us.

Influence our roadmap.

Get preferred commercial terms for being early.

You can:

Book a demo to see Sharpei AI on a real EF workflow and become a design partner, and we’ll schedule a deeper working session with your team

Sharpei started by helping brands launch leasing.

Sharpei AI is here to help the equipment finance teams behind those programs finally get the kind of tools they deserve.

If you’re building the future of equipment finance, we’d like to build it with you.

See you out there.

Related posts

Ready To Join The Circular Movement?

United for a smarter shopping experience and a better planet