AI Credit Scoring: How Artificial Intelligence is Transforming Lending

Sofia Rangoni

Dec 8, 2025

What is AI Credit Scoring?

AI credit scoring goes far beyond the standard checks most people associate with getting a loan. Instead of relying solely on a few numbers pulled from your credit history, artificial intelligence uses smart algorithms to analyze a much wider pool of information. AI models can examine patterns in everything from payment trends and transaction behavior to digital footprints, social signals, and alternative financial data, helping lenders paint a fuller picture of someone’s creditworthiness.

How it Differs from Traditional Credit Scoring

Traditional credit scoring uses a handful of factors, like payment history, outstanding debt, age of credit accounts, and credit inquiries, to grade borrowers. These scores usually feel like a black box, fixed formulas with little flexibility, trained only on what’s in your credit file. In contrast, AI-driven scoring is dynamic. It adapts to new information and learns from broader patterns in the market, enabling assessments even for people who may have “thin” or no credit files. This flexibility offers a route to credit for those previously left out.

Key Concepts and Terms Explained

You’ll see terms like “machine learning,” which means algorithms can spot subtle connections in data and fine-tune decisions over time. “Alternative data” refers to sources outside normal credit bureaus, such as utilities, rent payments, online activities, or even mobile phone usage. “Predictive analytics” is used to estimate the likelihood that someone will repay a loan based on these diverse signals. Together, these concepts push credit scoring into new territory, making the process more nuanced than ever.

Understanding these shifts sets the groundwork for seeing how AI tools actually work behind the scenes in lending decisions, and for appreciating the new opportunities (and challenges) they create for both borrowers and lenders alike.

How AI Credit Scoring Works

Data Sources Beyond Credit Reports

AI credit scoring examines far more than a traditional FICO score and payment history. In addition to standard data from credit bureaus, AI models absorb information such as online transaction behavior, utility payments, rent records, employment histories, and even social signals. This broader data palette lets lenders evaluate individuals who might otherwise lack a formal credit footprint, capturing financial habits that legacy systems overlook.

Machine Learning Models in Practice

Machine learning models digest complex datasets and search for patterns tied to repayment behavior. Unlike rigid scoring formulas, these models refine themselves over time, factoring in evolving consumer trends and new economic signals. A single application often triggers dozens of algorithms running in parallel, each weighing risk from a distinct angle, such as sudden changes in spending, seasonal income fluctuations, or shifts in digital footprints.

This diagram presents the variety of models, decision trees, neural networks, and more, that lenders deploy to tease out subtler clues about creditworthiness, helping them avoid the blind spots of one-size-fits-all approaches.

Real-Time and Automated Decision Making

Once relevant data and model outputs are in place, AI systems can issue a credit decision in seconds. Automation eliminates long waits, manual review bottlenecks, and paperwork. For applicants, this means instant results. For lenders, it strengthens risk controls by flagging anomalies in real time and adapting to shifting market conditions with minimal lag.

Peering into how these AI systems impact applicants and lenders makes it clear why their adoption has rapidly accelerated. Next, let’s explore the tangible benefits, both for lenders seeking smarter risk management and for people traditionally left out of the credit conversation.

Benefits of AI Credit Scoring

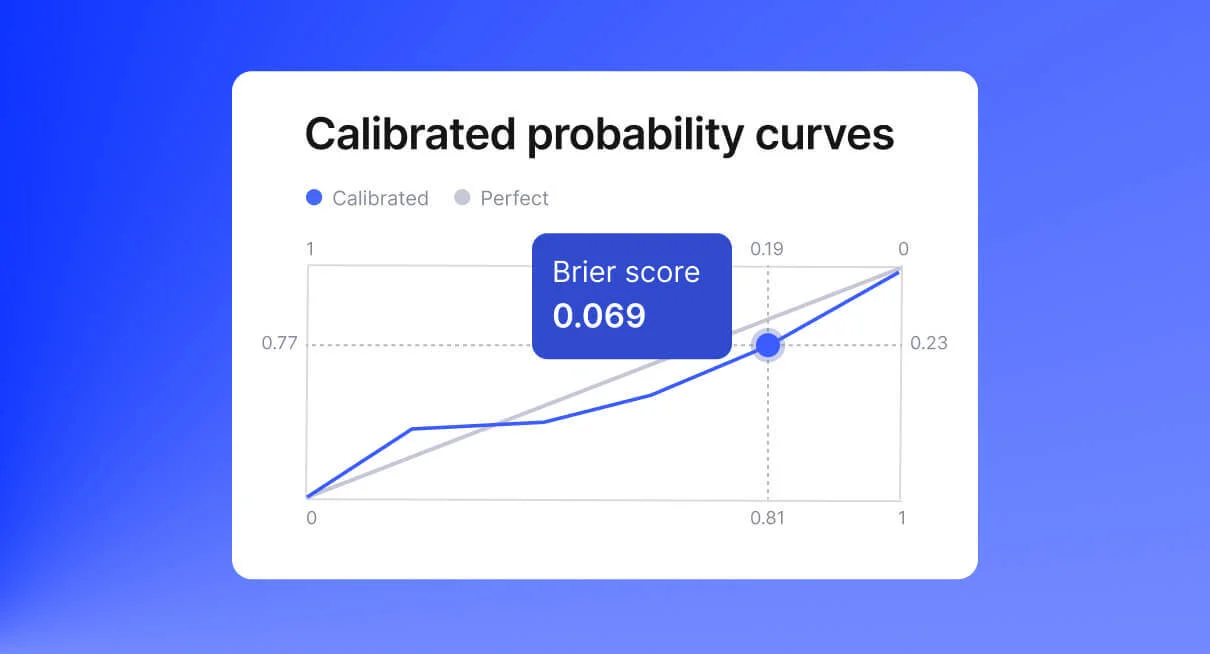

Improved Accuracy and Speed

AI-powered credit scoring systems evaluate thousands of data points in seconds, far beyond what traditional methods can manage. Using advanced machine learning, they detect nuanced patterns and subtle risks that classical models might miss. This means more accurate credit decisions and a significant reduction in approval times for borrowers.

The chart above highlights how AI credit scoring models not only outperform legacy scoring systems in precision but can also help borrowers receive instant feedback, eliminating the days or weeks of anxious waiting often tied to loan applications.

Expanding Access to Credit

Traditional credit scoring often leaves people without formal credit histories on the sidelines. AI credit scoring can analyze alternative data, such as utility bill payments or even online transaction behavior, to create a more complete and inclusive risk profile. As a result, individuals previously considered "credit invisible" can finally gain access to loans and financial services, opening doors to opportunity and economic upward mobility.

Reducing Human Error and Bias

By automating the evaluation process, AI scoring can minimize subjective decisions and inconsistencies that stem from manual review. While no algorithm is inherently bias-free, machine learning models can be systematically tested and retrained to mitigate unfair outcomes. Continuous monitoring ensures lending decisions are more consistent, objective, and less prone to personal or cultural biases than traditional manual assessments.

While AI systems offer striking improvements in lending fairness and efficiency, they also introduce new challenges and questions, especially around transparency, accountability, and data privacy. The next section explores these critical considerations, which every lender and borrower should understand as AI credit scoring becomes the new norm.

Challenges and Ethical Considerations

Transparency and Explainability

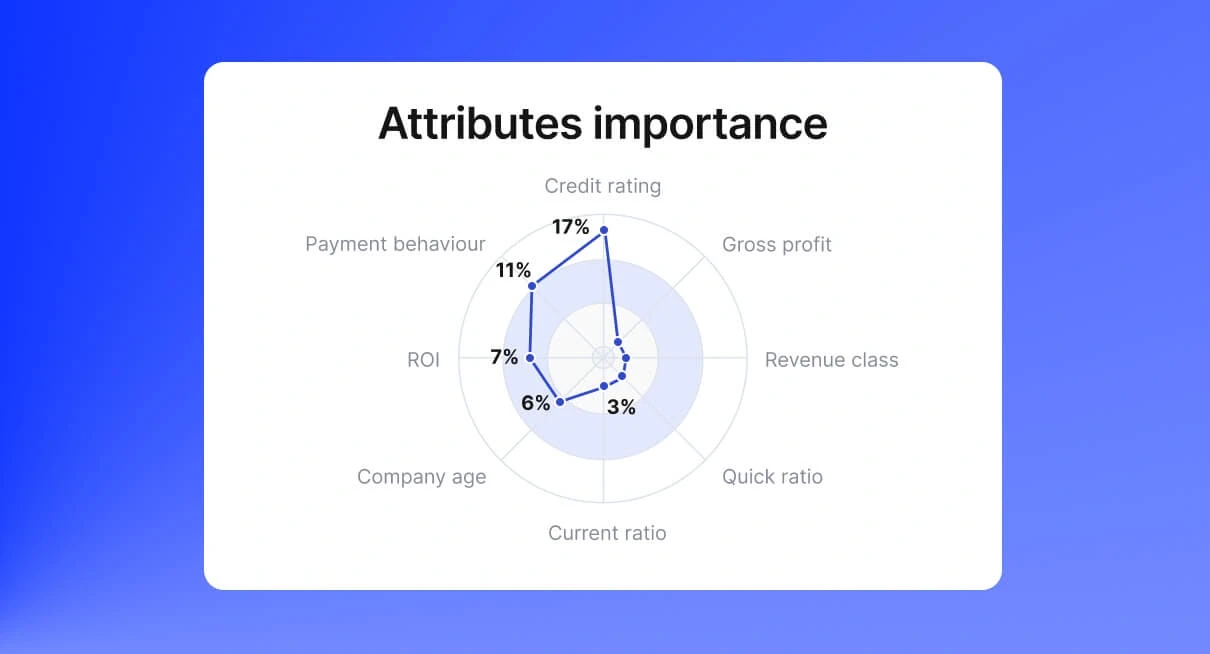

AI credit scoring systems aren’t always easy to decipher. When a machine learning model delivers a decision about a borrower’s risk, the “why” behind that result often hides inside thousands of variables and nonlinear connections. For borrowers and regulators, this can be unsettling, a black-box verdict is hard to challenge or trust. Increasingly, there’s pressure on lenders to open the hood and show how specific features (like payment habits or social media activity) actually inform a prediction.

Efforts to build “explainable AI” have become essential. Visual models and tools, like radar charts, attempt to break down how much weight an algorithm gives to each factor. But real transparency means more than just charts, it means systems that lenders and applicants alike can understand.

Addressing Bias and Discrimination

Algorithms are only as fair as the data that feeds them. Historical data often mirrors old prejudices, whether by zip code, education level, or employment history. If unaddressed, these biases can bake discrimination right into automated credit decisions, shutting out applicants not because of financial risk, but because of who they are, or where they’re from.

Financial institutions must carefully evaluate models for “algorithmic redlining” and disproportionate outcomes. Techniques like bias audits and adversarial testing become necessary checkpoints. The ethical bar is high: providing equal opportunity means confronting uncomfortable truths about both data sources and modelling decisions.

Data Privacy and Security

AI credit scoring thrives on data, the more granular and predictive, the better. But with that appetite comes the responsibility to protect what’s gathered, from bank statements to social profiles to real-time behavioral signals. Failing to secure this information risks exposing people to identity theft, targeted scams, or unwarranted surveillance.

Regulatory requirements, such as GDPR and other privacy laws, force lenders to be crystal clear about consent, storage, and data retention. Secure architectures and encryption are no longer optional. In parallel, organizations must constantly calibrate their practices: too lax invites risk; too strict reduces the predictive power of their models.

These roadblocks don’t mean progress stops. Instead, they prompt ongoing innovation and rigorous accountability. In practice, overcoming these hurdles is what allows digital lending platforms and financial institutions alike to truly put AI scoring into real-world applications, and that’s our next stop.

AI Credit Scoring in Action

Banking and Online Lending

Walk into any major bank today, and you’ll find AI quietly shaping credit decisions behind the scenes. Instead of relying solely on credit bureau reports, lenders tap into AI models that scan income patterns, transaction histories, and even applicants’ digital footprints. This approach allows online lenders to deliver near-instant loan approvals, adapting in real time to everything from a customer’s cash flow profile to economic shifts in their location. Small business owners, gig workers, and first-time borrowers who may be overlooked by traditional checks are finding new doors open, sometimes within minutes of applying.

Insurance and E-commerce Applications

AI credit scoring isn’t just for banks. In insurance, underwriters use AI-driven assessments to gauge risk when setting premium rates or approving policy applications in seconds rather than days. Over in e-commerce, buy-now-pay-later providers rely on AI scoring to greenlight shoppers, no lengthy forms or credit history required. These systems consider purchase frequency, digital device information, and online behavior to make sure approvals are fast and secure, even for those with little or no credit history.

Examples from Around the World

In Nigeria, fintech startups use AI to score mobile phone users based on airtime purchases and payment patterns, bringing credit access to millions for the first time. Chinese platforms like Ant Financial weave together a borrower’s utility bills, e-commerce activity, and social network data to build dynamic risk profiles. Meanwhile, in the U.S. and Europe, established banks and upstart lenders alike are harnessing AI to reduce defaults and expand lending to traditionally underserved communities. The mix of data sources and AI-driven insights means no two countries, or customers, look the same.

The landscape continues to shift as more industries and regions adopt innovative AI-powered credit assessment strategies. But what’s coming next, and how will the boundaries of possibility be pushed even further? Let’s look ahead to see where this revolution is heading.

Future Trends in AI Credit Scoring

Hybrid Models and Human Oversight

The next evolution in AI credit scoring will blend machine intelligence with human judgment. While algorithms excel at processing vast datasets and spotting subtle patterns, human experts remain essential for exceptions and ethical nuances. Expect to see more lenders employing hybrid systems: algorithms flag the straightforward decisions, while complex or ambiguous cases go to credit professionals. This not only maintains accountability but also builds trust for applicants wary of “black box” scoring.

Adapting Regulations and Guidelines

Regulatory landscapes are struggling to keep up with AI’s rapid advances. Lawmakers and oversight authorities worldwide are proposing rules for fairness, transparency, and explainability in automated lending. In the future, expect clearer guidelines around which data lenders can use, how decisions must be explained to borrowers, and stronger penalties when AI systems drift into bias. Frameworks will be tailored to protect consumers without choking off innovation.

Wider Adoption Across Industries

Originally the preserve of banks and fintechs, AI credit scoring is stepping into new territory. E-commerce providers, telecommunications firms, and even insurers are leveraging AI-driven insights to assess creditworthiness for loans, payment plans, or premium calculations. As the technology matures and regulations settle, expect a credit score powered by AI to shape more decisions in everyday life, from leasing an apartment to subscribing to new services.

As this transformation gathers pace, it’s important to anticipate, and be ready for, the most common questions people have as they encounter AI credit scoring in action.

Questions About AI Credit Scoring

How does an AI credit scoring model decide who is creditworthy?

AI credit scoring looks at a broad mix of data, not just your past loans and debts. It crunches thousands of data points, from payment habits to how often you move houses or sign in online. Through machine learning, the system discovers subtle patterns. Instead of sticking to inflexible rules, it spots risk in ways that sometimes surprise even the experts.

Can I know why I was denied credit by an AI system?

The short answer: it depends. Complex AI models have been compared to “black boxes,” making it hard to pin down the exact reason for each decision. Some lenders are working on tools to show you the most important factors, but true transparency isn’t always possible, yet.

Does AI credit scoring make lending fairer?

When designed and tested well, AI systems can reduce certain types of human bias, like gut feelings or unconscious prejudice. However, nothing is automatic: if the training data contains inequality, the model might learn and reinforce it. Responsible oversight and testing are crucial for fairness.

What if my unique situation isn’t in the data?

This is still a challenge for AI credit scoring. If your background or financial story is rare, the model might miss important context. Some lenders allow appeals or manual reviews, but the rise of automated decisions could make it harder for unusual cases to get a fair shake.

How is my data protected?

Strict rules cover how lenders use and store your information, but cybercriminals can target large datasets. The best systems use secure encryption and regular audits to keep your sensitive details out of the wrong hands.

Whether you’re seeking a loan, running a business, or simply curious about how lending decisions are made, understanding AI’s role is just the beginning.

Related posts

Ready To Join The Circular Movement?

United for a smarter shopping experience and a better planet